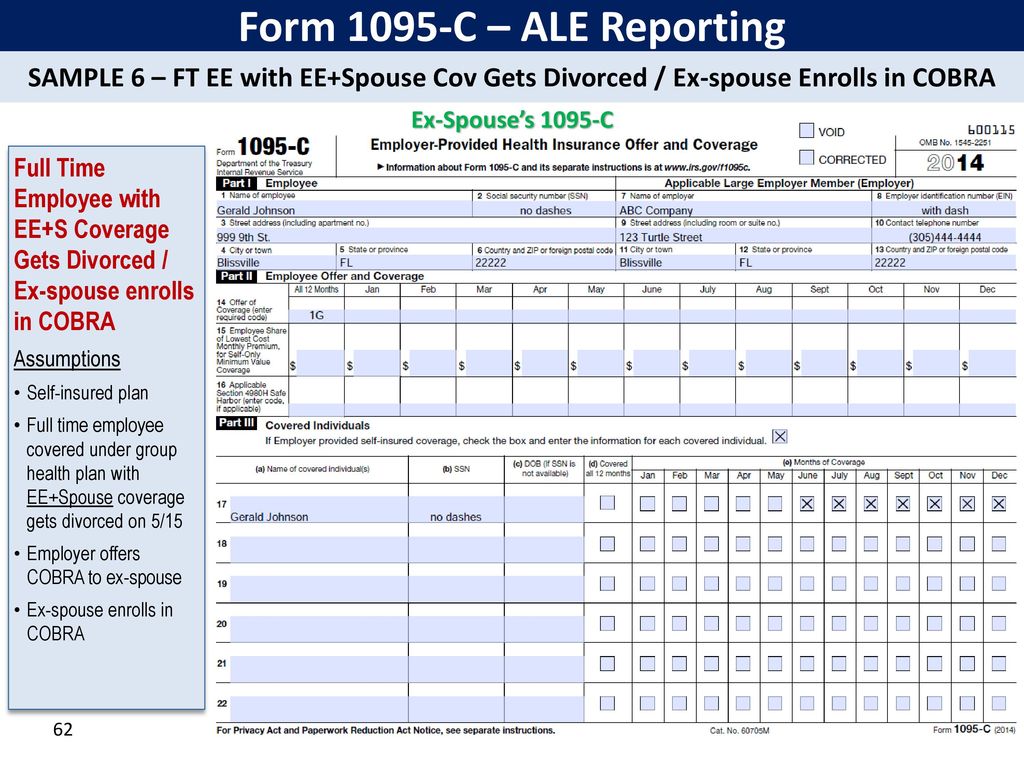

4//16 · For the 1095C, you only need to check the "Corrected" box on the form with the error, but you need to send it in with the 1094C — just don't check "Corrected" on that document Also, make sure you send your team the updated version as well 10 Your team doesn't have to do anything We're seriousLine 16 of IRS Form 1095C lists a code that describes, for each month in the previous year, the kind of coverage that an employee enrolled in, and how the employer meets the employer shared responsibility "Safe Harbor" provisions of Section 4980H Below is a description of the various codes in Code Series 2 2A Employee not employed during the month Enter code 2A if the10/3/18 · Example 1 ‐Full time & participating all year • Suzy Smith is a full time employee working for School District ABC, a large district participating in VEHI • Suzy is offered coverage and her spouse and dependents are eligible for the plan • Suzy

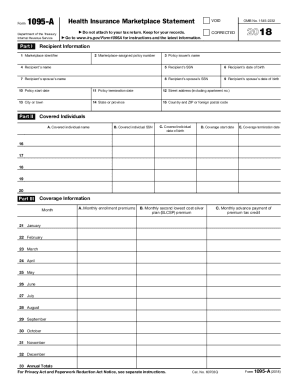

Form 1095 A 1095 B 1095 C And Instructions

1095-c examples 2020

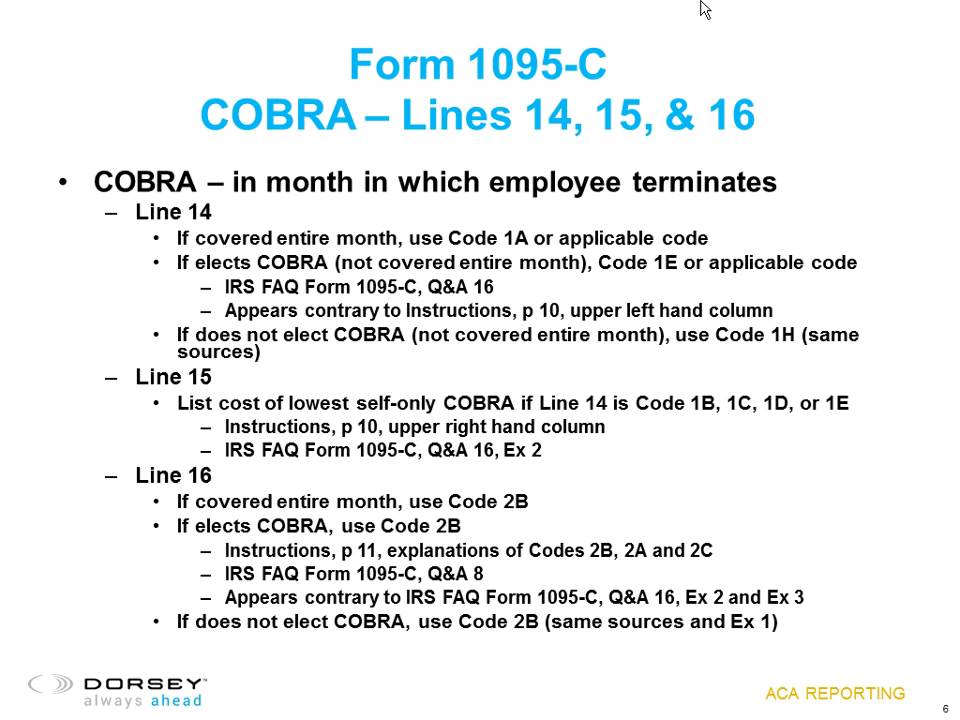

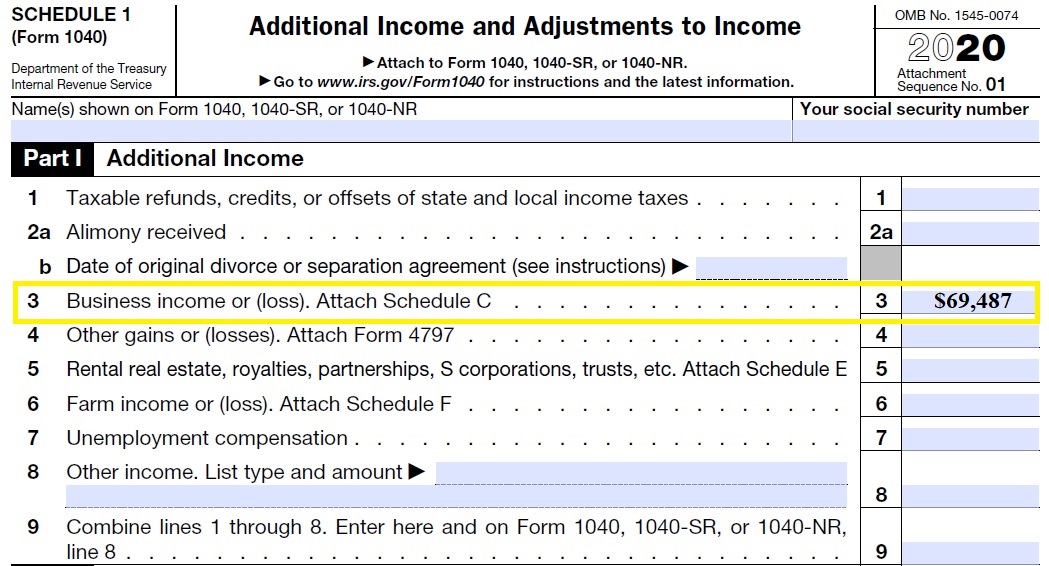

1095-c examples 2020-10/2/19 · To help employer complete forms 1094C and 1095C correctly, the IRS has provided answers to common questions These answers include instructions for reporting offers of COBRA continuation coverage The reporting requirements differ depending on whether COBRA was offered after termination of employment or after a reduction in hoursLet's Look At The Most Common 1095C Coverage Scenarios

Aca Reporting Preparing For 16 Deadlines Aca Reporting Preparing For 16 Deadlines Bradley Arends Alliance Benefit Group Financial Services Corp Ppt Download

Required line 14, line 16 codes of Form 1095C for you and send it for your review Upon approval, We will efile the 1094C and 1095C Forms with the IRS through the AIR System And also file with the NJ and DC We will mail copies to your employees Contact ACAwise now on (704) or email your requirements to support@acawisecomFor example, if you changed jobs during the year and were enrolled in coverage with both employers, you should receive a 1095C from each employer Note If you work for more than one job at the Commonwealth of Massachusetts (including working for one or more agency or higher education campus), you will receive one 1095C that will be inclusiveAll fulltime employees at companies with more than 50 fulltime employees will now receive a Form 1095C to report health care coverage offered by their emp

2/3/15 · 61 Form 1095C must be provided to the IRS by March 31, 17 (filing electronically) Form 1095C must provided to the IRS by Feb 28, 17 (filing paper) 62 I am probably going to need an extension on that one too 62 63 Form 09 is for you then 63 64FullTime Employee Enrolled All 12 Months;The Form 1095C includes information about the health insurance coverage offered to you and, if applicable, your family You may receive multiple Forms 1095C if you worked for multiple applicable large employers in the previous calendar year You may need to submit information from the form(s) as a part of your personal tax filing

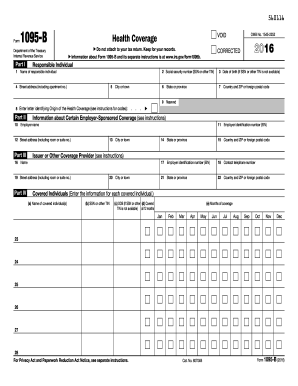

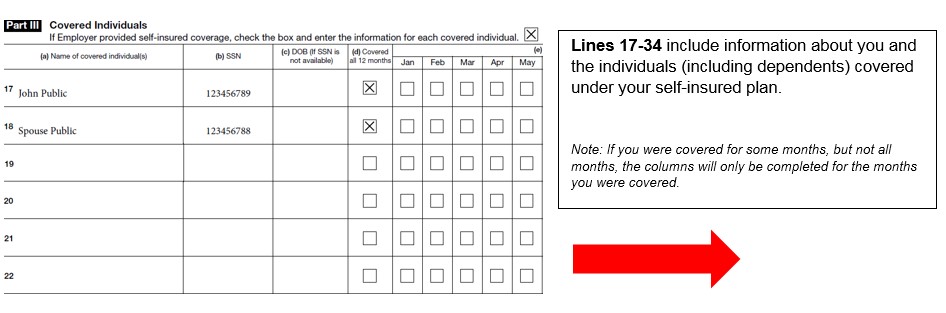

The individual identified in Part I of the Form 1095C was not an FTE for even a single month during the year, but was enrolled in selfinsured coverage for at least one day Lockton CommentExamples include covered parttime employees, partners, nonemployee directors, independent contractors, retirees, and persons purchasing COBRA coverageIRS Form 1095C Indicator Codes for Lines 14, 15, and 16 Form 1095C, Part II, Line 14 Indicator Code Series 1 for "Offer of Coverage" 1A Qualifying Offer Minimum essential coverage providing minimum value offered to fulltime employee with employee contribution for self only coverage equal to or less than 95% mainland single1/18/15 · If they are fully insured, they get a 1095B from the insurer and fill out Sections I and II of 1095C Employers who have to file the forms will also need to file a 1094B or 1094C forms for Applicable Large Employer (ALE) requirements and to tell the IRS if you offered employees Minimum Essential Coverage (under PPACA section 6055 and section 6056)

New Form 1095 B 17 Models Form Ideas

Common 1095 C Coverage Scenarios With Examples Boomtax

FullTime Employee Waived Coverage All 12 Months;Form 1095C merely describes what coverage was made available to an employee A separate form, the 1095B, provides details about an employee's actual insurance coverage, including who in the worker's family was coveredThis form is sent out by theData, put and ask for legallybinding electronic signatures Do the job from any gadget and share docs by email or fax Check out now!

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

Irs Form 1095 C Codes Explained Integrity Data

For example, if an ALE Member separately reports for each of its two divisions, the ALE Member must combine the offer and coverage information for any employee who worked at both divisions during the calendar year so that a single Form 1095C is filed for the calendar year for that employee, which reports information for all 12 months of the calendar year from that ALE MemberGenerate and/or audit 1095C forms A full list of codes is available on our website 1095C Part II "Safe" Code Combinations Line 14 Line 16 Descriptive Examples 1A 2C FullTime employee, spouse, and dependents were offered MEC at Minimum Value2/24/ · When populating Form 1095C, employers are communicating a lot of information through a series of codes on Lines 14 and 16 It is incredibly important for an employer to have documentation supporting the codes they are using when populating the Forms 1095C Below is a general breakdown of the different codes that could be entered on Lines 14

Aca 1095 C Basic Concepts

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

PartTime Employee Becomes FullTime Midyear · The following is an example Corporation Alpha completely owns Corporation Bravo and Corporation Charlie, but Corporation Alpha doesn't have any employees Corporations Bravo and Charlie each have 60 fulltime employeesApplicable Large Employers hiring over 50 employees have to use 1095 C Form This document should contain information for employerprovided Health Insurance Offer and Coverage Every fulltime employee has to meet certain health standards For its part, every ALE should pay, record and report insurance expenses to the Internal Revenue Service

1094 C 1095 C Software 599 1095 C Software

1094 C 1095 C Software 599 1095 C Software

John Barlament walks through how to fill out IRS forms 1094C and 1095C This presentation was given to selffunded employers at an Alliance Learning CircleFullTime Employee Hired Midyear, Qualifying offer;FORM 1095C, LINES 14 16, CODING EXAMPLES Listed, below, are Form 1095C coding directions for various scenarios For purposes of these scenarios, we will assume that, pursuant to its enrollment guidelines, the city or town provides coverage to an ACA fulltime employee on her/his first day of employment and terminates

Aca Reporting Tip 19 Self Funded Plans Usi Insurance Services

Common 1095 C Coverage Scenarios With Examples Boomtax

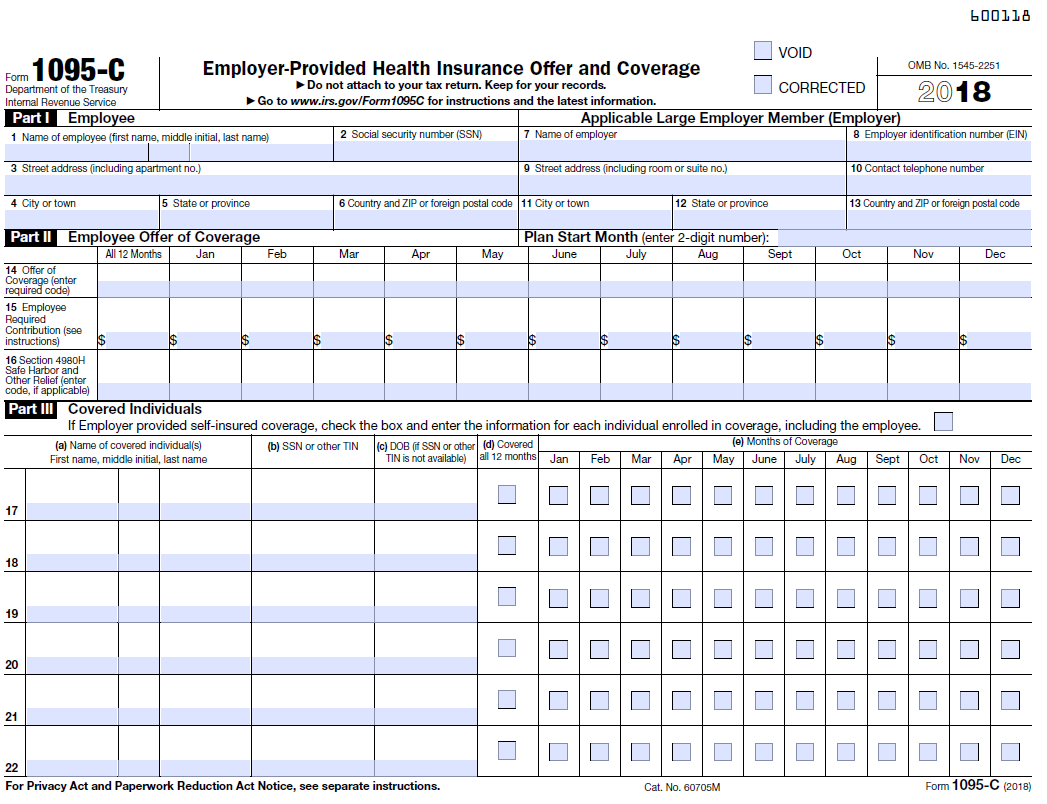

2/15/18 · Below is Form 1095C from the IRS website This guide will explain each piece of the form and help you determine the proper codes for the fields in Part II Shown below in blue, Parts I and III are comprised of lines 113 and 1734, respectively These sections are easy enough, just employee information Part IIApplicable Large Employers (for example, you left employment with one Applicable Large Employer and began a new position of employment with another Applicable Large Employer) In that situation, each Form 1095C would have information only about the health insurance coverage offered to you by the employer identified on the formLine 16 Codes of Form 1095C, Safe Harbor IRS designed the Code Series 2 indicator codes from 2A to 2I to determine affordability For example, if a 2H is entered, this indicates that the employer used the Rate of Pay Safe Harbor to determine the affordability Click here to learn more about ACA Form 1095C Line 16 Codes

Aca Reporting Tackling Complex Form 1095 C Situations And Preparing For Form 1094 C Youtube

Form 1095 A 1095 B 1095 C And Instructions

· 1095 C Form Example October 13, 18 by Mathilde Émond 24 posts related to 1095 C Form Example Aca Form 1095 C 1095 C Form 16 1095 C Form 17 1095 C Form 19 1095 C Form Deadline 1095 C Form Instructions 1095 C Form Meaning 1095 C Form Turbotax Aca Form 1095 Codes9/30/18 · An example of a letter is proposed in the article below The official letters occupy a vital place in the world of the market It is essential to understand how to write an official letter Higher letter writing skills will allow you to write appropriate donation letters In March, you will receive your 1095C formACA Form 1095 C CodeSheet for Line 14 and Line 16 Updated on January , 21 1030am by, TaxBandits Choosing codes to report on lines 14, 15, and 16 of 1095 C might be a tedious process for anyone But, when you look closely, it is pretty much simple

Free 1095 C Resource Employee Faqs Yarber Creative

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png)

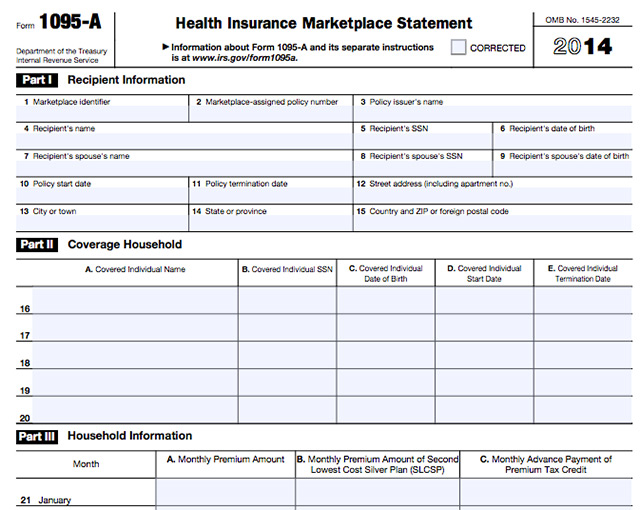

About Form 1095 A Health Insurance Marketplace Statement Definition

· The ACA requires that ALEs – any organization with 50 or more fulltime employees (including fulltime equivalents (FTEs) – provide each fulltime employee, as well as any employee who was enrolled in their health insurance plan with a Form 1095C So, for example, if you were a fulltime employee, regardless of whether or not you wereForm 1095C Part II Filing Guide Answer the questions below to help you better understand what codes to enter in Lines 1417 of Form 1095C Please note that this information covers common scenarios and is not allinclusiveFullTime Employee Hired Midyear;

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Aca Reporting Preparing For 16 Deadlines Aca Reporting Preparing For 16 Deadlines Bradley Arends Alliance Benefit Group Financial Services Corp Ppt Download

10/3/19 · Reading IRS Form 1095C Updated October 03, 19For Administrators and Employees Here's a quick reference guide to reading the various codes in IRS Form 1095C Code Series 1 for Form 1095C, Line 14 Line 14 of IRS Form 1095C lists a code that describes whether an employee was offered coverage by their employer, the type of the coverageACA Code Reference Guide Form 1095C Line 16 – Code Series 1 Important Note Regarding Affordability References to affordability relate to affordability at the employee only coverage level It does not matter if the employee actually elects coverage for him orAca Form 1095 C Examples adahveum February 5, 19 Templates No Comments 21 posts related to Aca Form 1095 C Examples 1095 C Form Example Aca Form 1095 C 1095 C Form Meaning Aca Form 1095 C Codes Print 1095 A Form 1095 C Form 19 1095 C Form 16 Print 1095 A Tax Form 1095 C Form Turbotax

Form 1095 A 1095 B 1095 C And Instructions

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

1//21 · Form 1095C Line by Line Instructions Updated on January , 21 1030am by, TaxBandits IRS Form 1095C is used by Applicable Large Employers (ALEs) to report the health insurance coverage information provided to their fulltime employees and employee's dependents For the tax year , form 1095C has been updated2/17/16 · Information included in the Form 1095C (including an explanation of Part III for selfinsured plans) Descriptions of why an employee may receive multiple Forms 1095C As a special bonus, we have also included a sample employee letter for use by small selfinsuring employers —generally those with fewer than 50 fulltime employees (includingForm 1095C is the IRS form employers provide to their employees detailing employerbased health coverage they received during that calendar year Every applicable large employer (ALE) needs to furnish a Form 1095C to each employee with information about their medical benefits for reporting purposes

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

1095 C 18 Public Documents 1099 Pro Wiki

3/12/15 · Here are a few more questions from our webinar, "Mastering 1095C Forms for ACA Compliance" If you missed the webinar, you can replay it hereThese questions cover measurement and stability periods, Union questions, waiting periods, and specifics on the forms3/10/21 · Plan Start Month This is an unnumbered line that is optional for the 15 Form 1095C, but the IRS anticipates it'll be mandatory for the 16 version Put a twodigit number (01 through 12), which indicates the month that the plan year begins for the health insuranceNote that substitute forms may be used, but the substitute forms must include all of the information required by Forms 1094C and 1095C and must satisfy all of the IRS's form and content requirements Forms 1094B and 1095B are to be used by a small selfinsured employer that is not an ALE for Section 6055 purposes

Irs Form 1095 C Codes Explained Integrity Data

Common 1095 C Coverage Scenarios With Examples Boomtax

1095C Department of the Treasury Internal Revenue Service EmployerProvided Health Insurance Offer and Coverage (for selfonly minimum essential coverage Information about Form 1095C and its separate instructions is at wwwirsgov/form1095c OMB No 15 share of the lowestcost monthly premium Part I EmployeeB1 Understanding the Sources for Forms 1095C and 1094C and1095C XML The Form 1095C print and the 1094C or 1095C XML files are handled through the JD Edwards Electronic Document Delivery (EDD) system The system uses the data item aliases during the spool file batch export step to create XML source files, which are then used to map the information toCreating the 1095C spreadsheet to be imported Although you can create your own spreadsheet to import 1095C information for your clients' employees, we recommend that you use the 1095C template spreadsheet that we have made available for exportThe 1095C template spreadsheet exports from Accounting CS populated with basic employee information that is formatted to match the Sample

1040 Affordable Care Act Aca Data Entry And Faqs

Form 1095 A 1095 B 1095 C And Instructions

1095c examples Reap the benefits of a electronic solution to develop, edit and sign contracts in PDF or Word format on the web Turn them into templates for multiple use, add fillable fields to gather recipients?Form 1095C An IRS form sent to anyone who was offered health insurance coverage through his or her employer The form includes information you may have to provide on your federal tax return2/18/21 · Key Points about completing Form 1095C You have until March 2, 21 to deliver Form 1095C to your employees The codes you use to complete these forms depend on the coverage you offer, whether your employee enrolls, and other employment changes We outline common example scenarios to help you choose the appropriate codes for lines 14 and 16

1040 Affordable Care Act Aca Data Entry And Faqs

How To Accurately Complete Lines 14 16 On Irs Form 1095 C

· For example, if an employee is offered coverage for plans that begin in January and July, the employee's Form 1095C plan start month box should be completed with 01 If there is no plan under which coverage is offered to the employee, 00 should be entered in10/27/18 · Aca Form 1095 C Examples October 27, 18 by Mathilde Émond 24 posts related to Aca Form 1095 C Examples 1095 C Form Example Aca Form 1095 C 1095 C Form 16 1095 C Form 17 1095 C Form 19 1095 C Form Deadline 1095 C Form Instructions 1095 C Form Meaning 1095 C Form TurbotaxForm 1095C Decoder If you were a fulltime employee working 30 or more hours per week or enrolled in healthcare coverage from your employer at any point in , you should receive a Form 1095C If you received a Form 1095C from your employer and you're not sure what the codes mean, check out our 1095C Decoder to learn more

Common 1095 C Coverage Scenarios With Examples Boomtax

Aca Code Cheatsheet

10// · What is Form 1095C?5/5/ · Common 1095C Coverage Scenarios FullTime Employee Enrolled all 12 Months, qualifying offer;

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Aca Reporting Penalties Abd Insurance Financial Services

Form 1095 A 1095 B 1095 C And Instructions

Employer Reporting June Ppt Download

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

File Taxes For Obamacare

9 Aca Affordable Care Act Software Ideas Irs Forms Tax Forms Efile

New 1095 C Codes Will Apply To The Tax Year Aca The New 1095 C Codes For Explained

Irs Form 1095 C Codes Explained Integrity Data

250 W 2 And 1099 Software Ideas Irs Irs Forms Efile

Ez1095 Software How To Print Form 1095 C And 1094 C

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

1095 C Form 18 Awesome Examples Resumes 17 Basic Resume Model Gallery Resume Format Models Form Ideas

Irs Tax Forms Wikipedia

Code Series 2 For Form 1095 C Line 16

Common 1095 C Coverage Scenarios With Examples Boomtax

Form 1095 C Guide For Employees Contact Us

Aca Reporting Tip 19 Self Funded Plans Usi Insurance Services

250 W 2 And 1099 Software Ideas Irs Irs Forms Efile

Accurate 1095 C Forms Reporting A Primer Integrity Data

1095 C Print Mail s

Fillable 1095c Fill Online Printable Fillable Blank Pdffiller

Irs Form 1095 C Codes Explained Integrity Data

Irs Form 1095 C Codes Explained Integrity Data

Common 1095 C Coverage Scenarios With Examples Boomtax

Aca 1095 C Basic Concepts

Accurate 1095 C Forms Reporting A Primer Integrity Data

Aca 1095 C Basic Concepts

A Z Important Terms To Know For Forms 1094 1095 C Ts1099 Ts1099

Form 1095 C Forms Human Resources Vanderbilt University

Form 1095 C Forms Human Resources Vanderbilt University

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

Irs Form 1095 C Fauquier County Va

Common 1095 C Coverage Scenarios With Examples Boomtax

Health Insurance 1095a Subsidy Flow Through Irs Tax Return

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Aca 1095 C Basic Concepts

Ez1095 Software How To Print Form 1095 C And 1094 C

Sample 1095 C Forms Aca Track Support

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Common 1095 C Coverage Scenarios With Examples Boomtax

Common 1095 C Coverage Scenarios With Examples Boomtax

F O R M 1 0 9 5 C E X A M P L E S Zonealarm Results

What Individuals Need To Know About The Affordable Care Act For 16

Aca Code Cheatsheet

Irs Form 1095 C Codes Explained Integrity Data

:max_bytes(150000):strip_icc()/1095b-741f9631132347ab8f1d83647278c783.jpg)

Form 1095 B Health Coverage Definition

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

1095 A Form Fill Out And Sign Printable Pdf Template Signnow

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

1095 C Eemployers Solutions Inc

Aca 1095 C Basic Concepts

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

0 件のコメント:

コメントを投稿